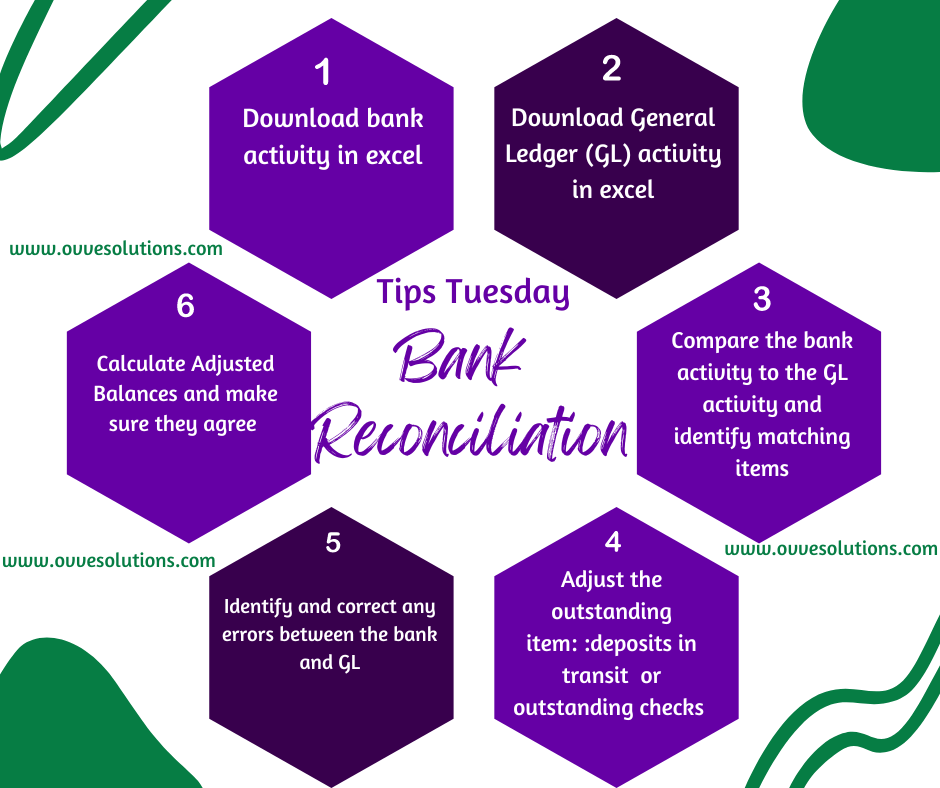

Here are the steps for performing a Bank Reconciliation.

1. Extract Data: Obtain the bank statement and cash book for the period.

2. Match Transactions: Tick off transactions that appear in both the bank statement and cash book.

3. Identify Discrepancies: Highlight transactions that do not match or are missing.

4. Adjust for Outstanding Items: Account for outstanding checks and deposits in transit.

5. Correct Errors: Adjust any errors in the cash book or bank statement.

6. Calculate Adjusted Balances: Ensure the adjusted balances in the cash book and bank statement match.

7. Document: Prepare and review the reconciliation statement.

Tips for Effective Bank Reconciliation

Regular Reconciliation: Perform bank reconciliations regularly, ideally monthly, to maintain accurate records.

Automation: Use accounting software to automate data entry and reconciliation where possible.

Detailed Records: Maintain detailed records of all transactions, including receipts and payments.

Clear Policies: Establish clear policies and procedures for recording transactions and conducting reconciliations.

Training: Ensure staff involved in the reconciliation process are well-trained and understand the importance of accuracy.