For business owners and professionals, managing finances isn’t just about tracking income and expenses, it’s about making every dollar count. Whether you’re running a consulting firm, a mental health practice, or a nonprofit, maximizing cash flow efficiency is the key to sustainable growth and financial stability.

We believe in smarter financial management. From budgeting to forecasting, we help you uncover hidden opportunities in your cash flow so you can focus on what truly matters: growing your business.

The Importance of Cash Flow Efficiency

Cash flow is the backbone of your business. A steady and predictable cash flow ensures you can cover operational expenses, reinvest in growth, and weather unexpected financial challenges. However, many business owners struggle with cash flow management, often due to:

- Late payments from clients or donors.

- Optimized spending habits.

- Lack of clear financial forecasting.

- Uncertainty in budgeting for future expenses.

The good news? With the right strategies, you can turn cash flow from a challenge into an opportunity.

Smart Strategies to Maximize Every Dollar

1. Optimize Your Budgeting Process

A well-structured budget isn’t just about cutting costs, it’s about allocating resources wisely. We help businesses:

- Identify key spending areas.

- Reduce unnecessary expenses.

- Allocate funds to high-impact growth initiatives.

By analyzing your financial data, we create a customized budget that ensures every dollar is working toward your business goals.

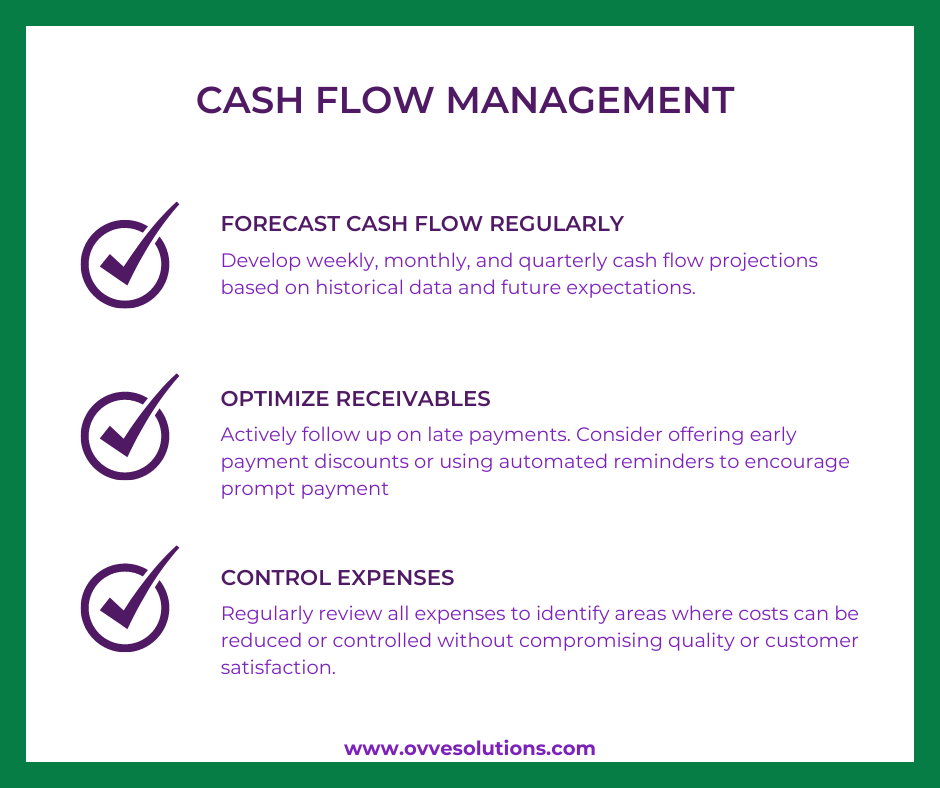

2. Improve Cash Flow Forecasting

Forecasting isn’t just for large corporations. Small businesses and nonprofits can greatly benefit from predictive cash flow analysis. Our approach includes:

- Tracking income and expenses in real time.

- Identifying seasonal trends and revenue patterns.

- Creating forward-looking financial projections to avoid cash shortages.

With better forecasting, you can anticipate financial needs before they arise, ensuring long-term stability.

3. Streamline Accounts Receivable and Payable

One of the biggest cash flow killers is inconsistent billing and slow payments. Our solutions include:

- Automated invoice and payment reminders.

- Offering flexible payment options for clients.

- Reducing delays in reimbursements and donor contributions.

By tightening up accounts receivable processes, you ensure a steady flow of income without bottlenecks.

4. Identify Cost-Saving Opportunities

Many businesses overlook cost-saving opportunities that could significantly improve their bottom line. We help with:

- Audit expenses to uncover hidden savings.

- Negotiate better rates with vendors and suppliers.

- Leverage tax deductions and credits to reduce financial strain.

Small changes can lead to big improvements in your financial health.

5. Invest in Scalable Growth

Smart financial management isn’t just about cutting costs—it’s about knowing when and where to invest. We guide businesses in making strategic investments that lead to:

- Hiring the right talent at the right time.

- Expanding services or product lines without financial risk.

- Utilizing financial tools and technology to enhance efficiency.

When every dollar is accounted for, you can confidently scale your business without financial uncertainty.

Take Control of Your Cash Flow Today

Don’t let financial uncertainty hold your business back. By implementing smarter budgeting, forecasting, and cash flow strategies, you can unlock hidden opportunities and maximize the impact of every dollar.

At OVVE Accounting Solutions, we specialize in helping small businesses, consultants, and nonprofits make the most of their finances. Whether you need better budgeting tools, advanced forecasting models, or streamlined billing solutions, we’re here to help.