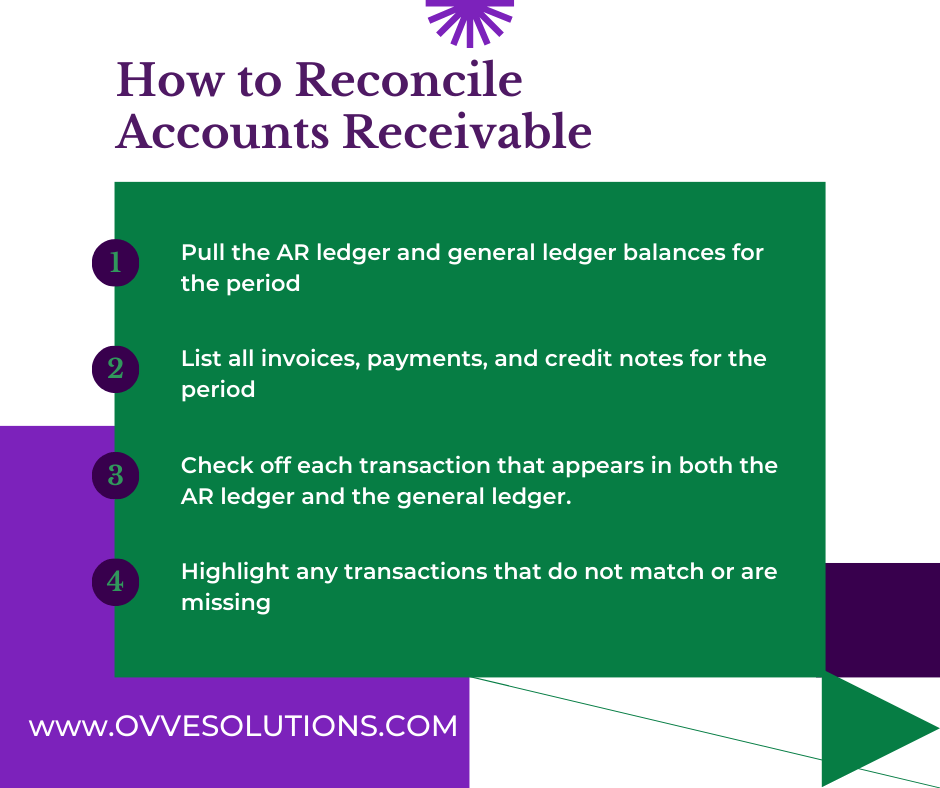

Step-by-Step Guide to Accounts Receivable Reconciliation

1. Gather Necessary Documents

Accounts Receivable Ledger: This is a detailed record of all transactions involving customer invoices and payments.

General Ledger: This includes a summary of all financial transactions, including those related to accounts receivable.

Customer Invoices: Detailed records of amounts billed to customers.

Payment Records: Records of payments received from customers.

Credit Notes: Records of any credit adjustments given to customers.

2. Prepare for Reconciliation

Period Selection: Determine the period you are reconciling (e.g., monthly).

Reconciliation Template: Use a reconciliation template or software to help organize the data.

3. Compare Balances

Opening Balances: Verify that the opening balances for accounts receivable in the ledger match the opening balances in the general ledger.

Ending Balances: Ensure the ending balances in both the accounts receivable ledger and the general ledger match.