Setting up a budget is essential for financial stability and growth.

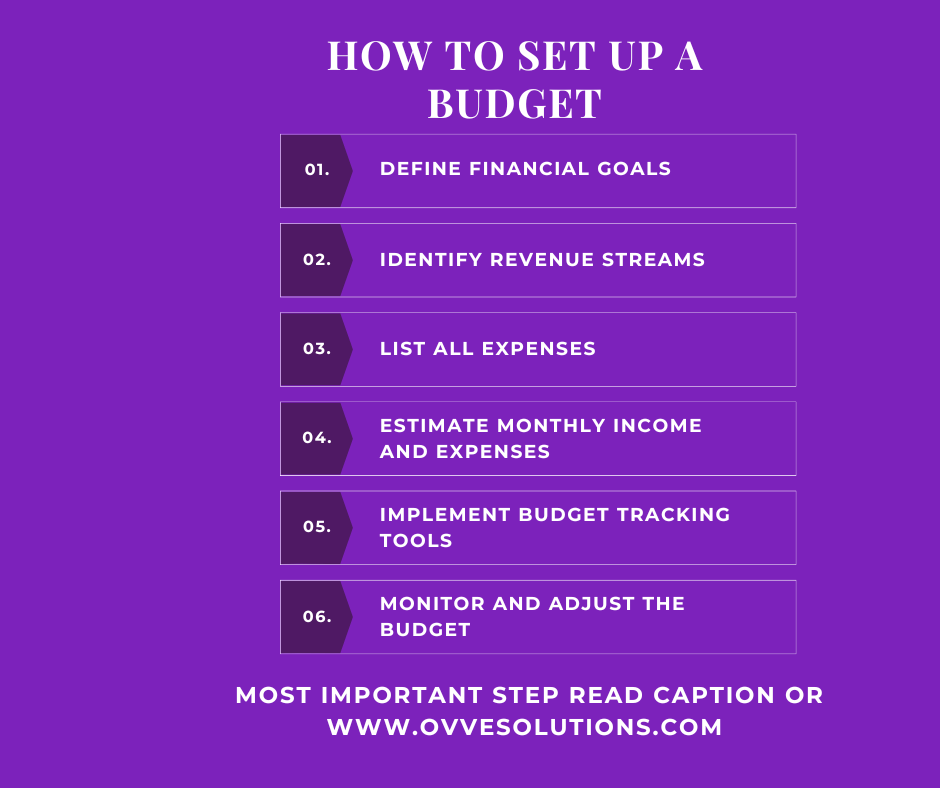

Steps to Set Up a Budget:

1. Define Financial Goals

• Short-Term Goals: Monthly and quarterly targets for revenue, expenses, and profit.

• Long-Term Goals: Annual financial targets, expansion plans, and savings goals.

2. Identify Revenue Streams

• Client Fees: Income from therapy sessions, consultations, and group sessions.

• Insurance Reimbursements: Payments received from insurance companies.

• Grants and Funding: Any grants or external funding received.

• Workshops and Seminars: Revenue from conducting workshops, seminars, or training programs.

3. List All Expenses

• Fixed Costs:

• Rent/Mortgage: Monthly rent or mortgage payments for the practice space.

• Salaries and Wages: Payments to therapists, administrative staff, and other employees.

• Utilities: Electricity, water, internet, and phone services.

• Insurance: Professional liability insurance, property insurance, and health insurance for employees.

• Variable Costs:

• Office Supplies: Stationery, therapy materials, and other office supplies.

• Marketing and Advertising: Costs associated with promoting the practice.

• Professional Development: Training, workshops, and conferences for staff.

• Technology: Software subscriptions, electronic health records (EHR) systems, and hardware maintenance.

• Miscellaneous: Any other expenses that may arise unexpectedly.

4. Estimate Monthly Income and Expenses

• Revenue Projections: Based on historical data and expected client volume

• Expense Projections: Based on past expenses and any anticipated changes.

5. Implement Budget Tracking Tools

• Accounting Software: Use accounting software to automate tracking of income and expenses.

OVVE SOLUTIONS has the tool for you when you sign up for monthly services.

6. Monitor and Adjust the Budget

• Analyze Variances: Identify any significant differences between the budgeted and actual figures.

• Adjust Projections: Modify the budget based on changes in revenue or unexpected expenses.

• Financial Reports: Generate monthly financial reports to keep track of the practice’s financial health.

7. Plan for Contingencies – most important step

• Emergency Fund: Set aside funds for unexpected expenses or revenue shortfalls.

• Cost-Cutting Measures: Identify areas where costs can be reduced if necessary.