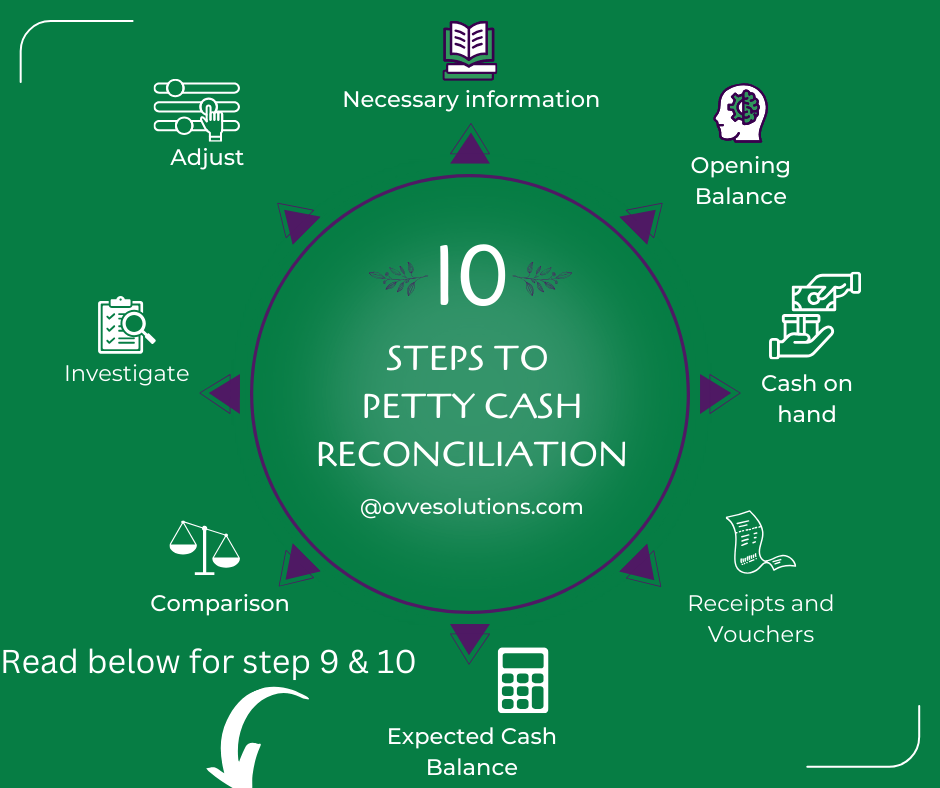

Here is the Step-by-Step Guide to Petty Cash Reconciliation

1. Gather Necessary Materials

– Petty Cash Log: The record of all petty cash transactions.

– Petty Cash Vouchers: Receipts and vouchers for each expenditure.

– Cash on Hand: The physical cash remaining in the petty cash box.

2. Verify the Opening Balance

– Confirm that the opening balance for the petty cash fund is accurate according to the previous reconciliation.

3. Count Cash on Hand

– Physically count the cash remaining in the petty cash box.

4. Summarize Receipts and Vouchers

– Collect all receipts and vouchers for petty cash expenditures since the last reconciliation.

– List and total all expenses documented by these receipts and vouchers.

5. Calculate Expected Cash Balance

– Formula: Starting Balance – Total Expenses = Expected Cash Balance.

– Ensure the starting balance matches the last reconciled petty cash balance.

6. Compare Cash on Hand to Expected Balance

– Check if the physical cash on hand matches the expected cash balance calculated.

7. Identify and Investigate Discrepancies

– Discrepancies: Note any differences between the expected balance and the actual cash on hand.

– Investigation: Investigate any discrepancies by reviewing receipts, vouchers, and the petty cash log.

8. Adjust the Records

– Correct Errors: Make necessary adjustments to the petty cash log for any errors found.

– Update Log: Ensure all transactions are recorded accurately in the petty cash log.

9. Replenish Petty Cash

– If the petty cash is running low, prepare a request to replenish the fund to its original balance.

– Record the replenishment in the petty cash log.

10. Document the Reconciliation

– Reconciliation Statement: Prepare a reconciliation statement that includes the starting balance, total expenses, actual cash on hand, and any discrepancies.

– Approval: Have the reconciliation reviewed and approved by a supervisor or manager.

Tips for Effective Petty Cash Management

– Regular Reconciliation: Perform petty cash reconciliation regularly, such as weekly or monthly, depending on the usage.

– Secure Storage: Keep petty cash in a secure, locked location.

– Detailed Records: Maintain detailed records of all transactions, including dated receipts and vouchers.

– Clear Policies: Establish and communicate clear policies for petty cash usage and documentation.

– Training: Ensure employees handling petty cash are trained in proper procedures and documentation.