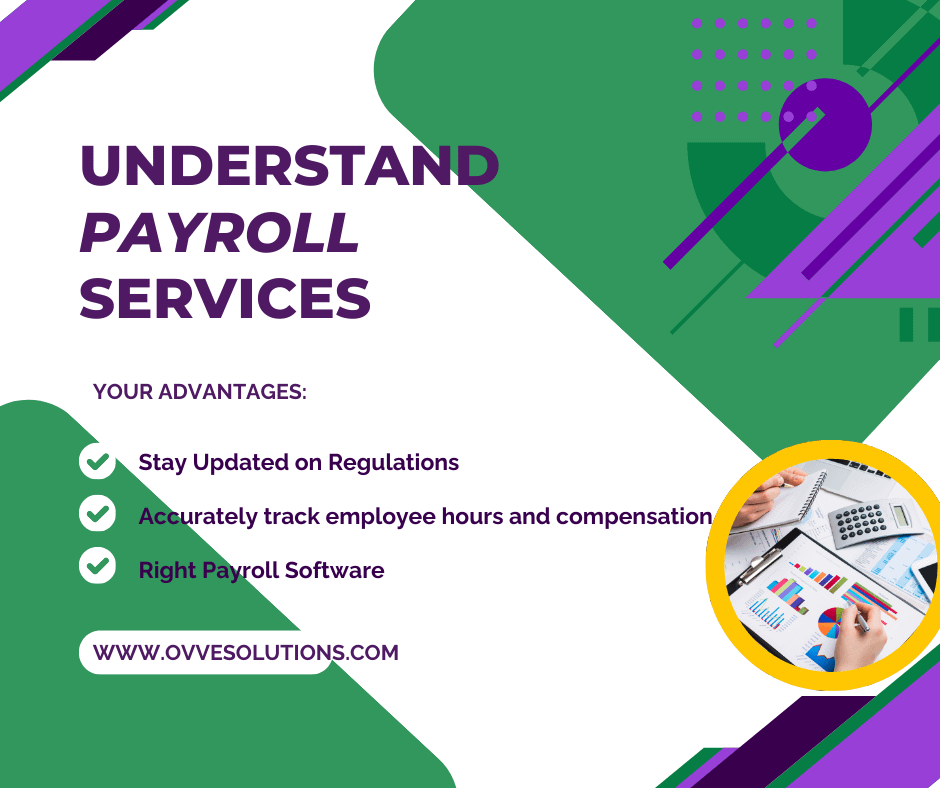

Managing payroll for a small team of 5 to 10 employees can be challenging, especially if you have limited knowledge. If managing payroll becomes too complex or time-consuming, consider outsourcing payroll to a professional service provider. This can help ensure accuracy and compliance while freeing up your time for other business tasks.

Understand Payroll Taxes and Compliance

• Basics of Payroll Taxes: Our specialists are familiarized with federal, state, and local payroll taxes, including income tax withholding, Social Security, Medicare, and unemployment taxes.

• Stay Compliant: Ensure you are compliant with labor laws, including minimum wage requirements, overtime rules, and employee classifications (e.g., full-time, part-time, independent contractor).

Accurately Track Employee Hours and Compensation

• Recordkeeping: Keeping detailed records of employee hours, pay rates, and any bonuses or commissions. Accurate record-keeping is essential for payroll processing and resolving any disputes.

Communicate Clearly with Employees

• Provide Payslips: Issue clear and detailed payslips to employees with each payroll, showing gross pay, deductions, and net pay. This transparency helps employees understand their compensation.

• Address Questions Promptly: Be available to answer any payroll-related questions or concerns your employees might have. Clear communication builds trust and reduces misunderstandings.

Set a Regular Payroll Schedule

• Consistent Schedule: Decide on a regular payroll schedule (e.g., weekly, bi-weekly, monthly) and stick to it. Consistency helps employees plan their finances and reduces confusion.

• Deadlines: Be aware of deadlines for submitting payroll information to avoid late payments and penalties.

Additional Tips

• Backup Data Regularly: Ensure all payroll data is backed up regularly to prevent loss of important information due to technical issues or errors. We got you covered!